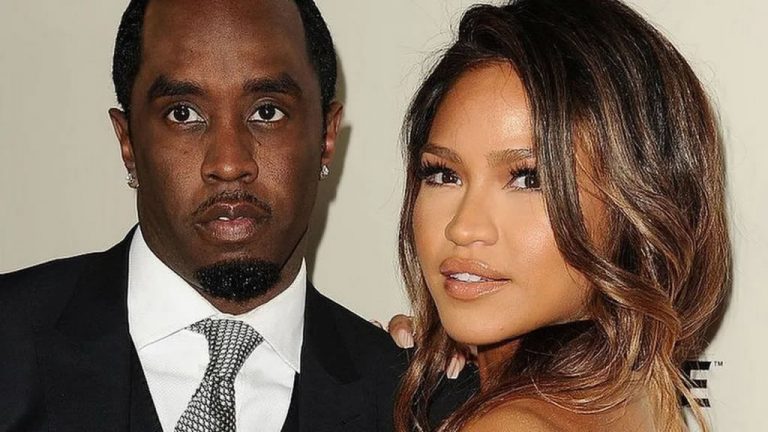

Rather than going out or ordering takeout, consider having friends and family over for a potluck dinner party.(GETTY IMAGES)

EVEN IF YOU HAVE HELD onto your job during the coronavirus pandemic, you probably are looking for smart spending strategies and have been more than anxious about your bank account.

RELATED CONTENT

Alternatives for Expensive Grocery Items

After all, the unemployment rate is high – officially it was 13.3% for May, although if it wasn’t for a data collections process error, according to the Bureau of Labor Statistics, it would be around 16.3% – and nobody knows what financial future lies ahead.

So if you’re looking for smart spending strategies in a tough economy, you may want to try the following.

- Create a budget.

- Dine out – at home.

- Plan out your meals.

- Track your spending.

- Before your buy, talk it over.

- Keep your credit card information off of websites.

- Apply for a credit card.

SEE:

25 Ways to Fix Your Finances Fast. ]

Create a Budget

In a nutshell, you can put together a budget by keeping track of your monthly expenses after taxes. Generally, that’s going to be housing expenses, food, clothing, health care, transportation and miscellaneous costs.

But, of course, it’s not that easy. If you have pets, do you spread out those costs over groceries (pet food) and health care (veterinary visits) or stick them into “miscellaneous”? What about the expenses that aren’t monthly but show up periodically throughout the year, like back-to-school shopping, holiday shopping, birthday gifts and oil changes?

All of that said, it really doesn’t matter how you categorize those hard-to-place expenses, as long as you keep track of them somewhere and somehow.

There are also numerous ways to keep track of a budget, from using money management apps to budget calendars to writing everything down on paper or in a Word document. You could spend hours and hours crafting the perfect budget – they’re that important.

Rebecca Hunter, CEO of TheLoadedPig.com, a personal finance website, has a smart suggestion to keep in mind for people creating – or reworking – a budget: Make sure your budget includes some room for fun stuff that you don’t need.

“So many people are trying budgeting strategies right now and may even try to cut out all wants from their spending. Unfortunately, this leads to impulse buying and, in some cases, racking up credit card debt. A way to prevent impulse buying and to maintain mental health is by allocating a small amount of your monthly budget to wants,” Hunter says.

Dine Out – at Home

So you’re tired of sheltering in place, and you want to see your friends and relatives – but from a health and financial perspective, you also aren’t sure you can afford to socialize.

Lauren Klein, a certified financial planner and the founder and president of Klein Financial Advisors in Newport Beach, California, has a suggestion that may reduce your odds of picking up the coronavirus – and should mean that you’ll spend less on entertainment expenses.

“Once it’s safe to socialize, consider inviting friends and family over to share the culinary skills they picked up during quarantine. Even when social distancing, having the gang over for an outdoor BYOB is a great way to relax while keeping your credit card safely locked away and your budget in check,” Klein says.

She also points out that, according to the BLS, before the pandemic, the average American household spent about $3,000 a year dining out. So this may well be a part of your budget that needs some work.

Plan Out Your Meals

Even though groceries are generally cheaper than restaurant food, many people likely spend more money at the supermarket than they need to because they don’t have much of a meal plan.

For instance, maybe on a Sunday afternoon, you buy something like ground beef assuming that later in the week you might make cheeseburgers or a hamburger noodle casserole or tacos. You’re not really sure what you’re going to make with it, but you’ll come up with something. So Wednesday comes, and tacos it is, but you realize you don’t have taco shells, or you end up only using half of the ground beef before throwing the rest away because you didn’t plan to use it for other meals before it spoiled. And now you’ve wasted money and food.

Careful meal planning for the weeks ahead before you go to the supermarket may help you spend less.

Track Your Spending

As noted earlier, having a budget is very important. Making sure you follow it is just as important. Otherwise, it’s almost as if you don’t have a budget.

Mike Earl, a certified financial planner at The Wealth Group in Minneapolis, advises you to go back in time with how you track your spending. Earl suggests not using or getting rid of apps that help you track spending and manage money – and instead manually track all of your spending. Earl says that he and his wife track their spending in a simple Google Drive spreadsheet.

“While apps and software can be great, being on autopilot in the area of spending and budgeting is not helpful,” Earl says. “Since the apps and software usually download all your transactions automatically, it means you’re not as mindful about each spending decision.”

Earl says that he used the popular money management website Mint.com, for years, “but it never put a dent in how much money I spent. Once I began tracking my own spending in a simple spreadsheet – this was nearly 10 years ago – my spending declined by 35% immediately.”

Before You Buy, Talk It Over With Your Partner or Yourself First

Joyce West is a career, business and executive coach who also owns a resume writing business in San Francisco. She says that whenever she or her husband plan to spend more than $35, they check with the other first.

“Of course, we could spend much more than that and $35 isn’t going to break the bank, but it really helps us practice good financial hygiene. Every little bit you save and invest now means you can retire way earlier,” West says.

Even if you’re single, you can come up with a version of this rule. For instance, maybe you like to impulse shop, and maybe you’ll continue to do that, but from here on, perhaps you develop a policy in which you don’t allow yourself to do impulse shopping for any item over $35 – or maybe $20 seems more responsible. If you come up with easy-to-follow spending policies, you may actually start to see yourself spending less money.

+ There are no comments

Add yours