Revival of the general model of American manufacturing

In fact, even if China does not intend to achieve global economic leadership through strategies involving large-scale government investment such as “Made in China 2025” and “One Belt One Road”, the United States has very good reasons for restoring its former manufacturing strength. The rise of China only makes America’s need to achieve this goal more urgent. China’s emphasis on state-owned capital allows the country to make long-term plans for its economic development, aiming and committing to dominate one new technology field after another; while the United States relies too much on the distortion of market signals from Wall Street (reliance on distorted market signals from Wall Street). ), which has caused the United States to be at a disadvantage in industrial development. As China becomes an infrastructure provider in developing countries, the geopolitical and geoeconomic influence brought by this new role to China is becoming increasingly prominent.

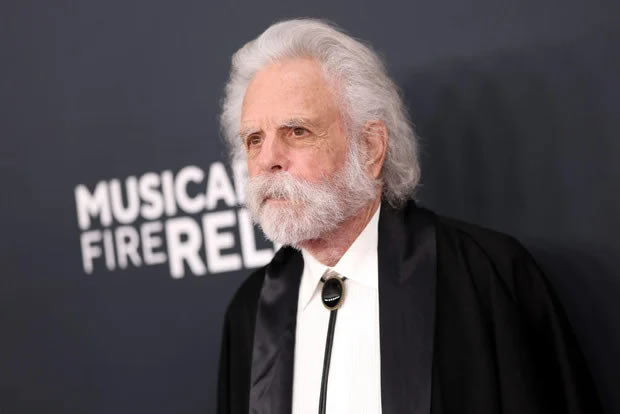

Robert Kutner, founder and co-editor of “American Outlook” magazine, and professor at Brandeis University, published a review article in the magazine on May 19, 2020: “In the post-epidemic era, we need “Made in America””, translation It is divided into two parts. This article is the second part.

After the first wave of manufacturing shifts occurred, economists Stephen Cohen and John Zysman from the University of California at Berkeley co-authored “The Importance of Manufacturing—— “Manufacturing Matters: The Myth of the Post-Industrial Economy” book. It now appears that this book is quite predictable for the future development of the US economy. They pointed out in the book that not only can the manufacturing industry provide jobs for the society, a large manufacturing enterprise can also play the role of a regional economic stabilizer.

Today in 2020, the manufacturing industry has become a ticket for a country to master the advanced technology of the future. After all, engineers are making technological innovations not far from the production workshop. If the United States loses its ability to manufacture machine tools, semiconductors, solar panels, or telecommunications equipment, a mercantilist rival like China will not only become a leading manufacturing power, but also a global leader in technological innovation. If the US government does not intervene, by then, the US will no longer have the qualifications to compete with China.

In the decades since Stephen Cohen and John Zisman published the monograph, the U.S. trade situation has grown from a slight surplus of $16 billion in 1975 to a severe deficit of $578 billion in 2019. In the field of high-tech products, it has developed from a basic balance of imports and exports to a deficit of US$132 billion. We have lost manufacturing technology and manufacturing capabilities in a large number of industries. In front of the U.S. Trade Representative, some lobby groups believe that the U.S. should no longer continue to manufacture nylon stockings, wedding dresses, or even print the Bible. However, these are the oldest traditional Western products.

In the post-epidemic era, US actions in the economic field should mainly focus on restoring manufacturing strength. Just as the Advanced Research Projects Agency of the Department of Defense once played the role of a state-owned investment bank in the field of dual-use technologies, the US government should also play a role in leading the development of the industry. In fact, the US government was already doing this during World War II. But this time, the main goal of the US government should be to prevent Beijing from leading the development of many emerging technologies through “Made in China 2025.” If Wall Street continues to sell out national interests in the future, then the US government should, like the Reconstruction Finance Corporation (the Reconstruction Finance Corporation) did during the Great Depression and World War II in the last century, own equity in high-tech companies and place public servants. In the company’s board of directors. On this basis, employee representatives will be able to play an icing on the cake.

On the surface, laissez-faire of economic activities is an unofficial ideology of laissez-faire in the United States. This ideology opposes the creation of large-scale “national champion companies” such as Siemens in Germany, Huawei in China, or Airbus in Europe. “(National champions), everything should be decided by the market. But there is an argument to the contrary that is difficult to refute. Boeing is already in serious trouble due to the catastrophic management problems that have occurred on the 737 MAX models. Since the U.S. government is doing its utmost to ensure Boeing’s solvency, in exchange, Boeing should allow the U.S. government to obtain a controlling stake in the company. As a private company that relies heavily on Wall Street, Boeing’s performance has been extremely bad. I believe that Boeing will only get better after becoming a state-owned company.

We have already seen that after so many American companies have received bailout funds, they do not know how to make better use of them other than stock repurchase and dividends. This shows that the “market” does not know how to find profitable investment opportunities in the private sector (“the market” doesn’t perceive productive investment opportunities in the private sector). However, in fact, there is no shortage of such investment opportunities in the US economic system. This is why the United States urgently needs to change the lack of state-owned capital.

From a managed economy to a green economy

Changing the absence of state-owned capital in the United States should be carried out simultaneously with the modernization of infrastructure and the transformation of the existing economic model to a more resilient circular economy model, and the latter two are actually long overdue. According to the assessment of the American Society of Civil Engineers, the funding gap for upgrading the national infrastructure is approximately US$4.5 trillion. The initiators of the 2009 “American Recovery and Reinvestment Act” claimed that the economic stimulus package was “timely, clearly targeted and temporary.” Then the new green investment initiative we are currently proposing should be well planned and open. Transparent and permanent. The current epidemic crisis has caused the labor market to collapse, but this also provides an excellent opportunity to implement a green economic stimulus plan. During the Great Depression of the last century, the government’s promotion of the construction of the Hoover Dam and the Golden Gate Bridge was not without purpose. Today, we can also convert idle resources into infrastructure needed by society.

Since taxes and public debt can be used to serve society, it is reasonable to be used to create jobs. However, according to some trade rules, such practices are often regarded as “illegitimate favoritism” (illegitimate favoritism). We can ignore such rules for the sake of America’s national rejuvenation. We can reach a new trade agreement with the EU, which holds the same views on the issue of mixed economy. As for China, which has a poor record on issues such as human rights, labor rights, and intellectual property protection, it must accept offsetting tariffs and regulations. For example, any company headquartered in the United States should not comply with China’s mandatory technology transfer regulations, and US companies will no longer be allowed to do so.

In order to initiate public investment and promote the green transformation of the economy at the national level, we also need to free American economic policies from the shackles of economic thinking that has been proven wrong. “Efficiency” (efficiency) is a word that people like to talk about. Recently, as the US media has concentrated discussions on the fragility of the supply chain, more and more people have admitted that “the United States pays too much attention to the efficiency of the supply chain, but ignores the flexibility of the supply chain.” Pascal, former Director-General of the World Trade Organization · Lamy (Pascal Lamy) recently made this statement at a conference hosted by the OECD and the Open Market Institute.

However, the concept of “efficiency” is inherently problematic. In my book Everything for Sale: The Virtues and Limits of Markets published in 1996, I pointed out that the concept of “efficiency” can have three interpretations: the first is Adam. Smith’s “efficiency”, this “efficiency” is based on the relationship between supply and demand; the second, Keynes’s “efficiency”, when the economy is down, this “efficiency” is the same as Adam Smith’s “efficiency” Concepts are conflicting; the third is Schumpeter’s “efficiency”, he believes that from a long-term perspective, innovation is the source of economic growth. In fact, when China participates in the global competition for technological innovation and economic growth, it completely ignores market price signals, and the United States did so during World War II.

Furthermore, the standard description of “efficiency” usually does not take into account the trillions of dollars in losses caused by wrong market prices. Climate change, the Great Depression of 1929, and the global financial crisis of 2008 are all examples of this. This situation. Those who define “efficiency” are actually assuming that there is no closed loop of feedback between official corruption, no market power, no economic power, and political power that sets rules. Therefore, when people usually talk about “efficiency”, they are actually slashing their feet to cater to the concept of “flexibility”. This is ridiculous and goes against historical facts. It is time to abandon this concept. After the Great Depression, the Keynesian Revolution, and the establishment of the Bretton Woods system, we all thought we could solve the problem once and for all, but in fact it was not the case.

After the end of World War II, the United States, Europe, and most of the third world countries all showed a relatively benign economic nationalism mentality: even if the Marshall Plan included state-owned banks and state-owned enterprises, the United States would have no objection; even if a country did Priority is given to suppliers in their own country for job creation, and other countries will not oppose it; even if the United States invests in jet aircraft, biotechnology, computer networks and other military technologies during the Cold War, it will generate commercial value and will not be rejected . But I don’t know when, American officials lost their sober thinking ability under the erosion of the Chicago School of economic thinking. After that, they gave up the “third way” after being bought by the Wall Street lobbying group and turned to go. Seeking the ridiculous “perfect market”.

At the same time, U.S. officials actually gave the green light to Chinese people who firmly believe in mercantilism. They believe that as long as Wall Street and major U.S. companies can share their own interests in dealing with the Chinese, there will be no What’s wrong. We must oppose this approach. The postwar social contract (the postwar social contract) should have a modern version of the 21st century, that is, we should reserve enough space for national policies.

We may soon enter an era driven by renewable electricity. But the current market prices still reflect too much fossil energy trading. We can only change the economic system from relying on fossil energy to embracing green energy through government regulations and subsidy policies. Future energy will not only be cleaner, but will also be cheaper and safer to use. The market often makes mistakes in pricing, which is why we still need government and democratic planning.

We need to formulate a strategy at the national level to regain US global dominance in advanced manufacturing and green energy. What needs to be emphasized is that in this process, the American industry will master new technologies, local small and medium-sized enterprises will achieve development, and American jobs will also increase substantially. We can do multiple things in one fell swoop. Of course, this may violate some people’s traditional views on free markets and free trade. In fact, we should abandon those wrong views long ago.

+ There are no comments

Add yours